Blog

Understanding Shadow Accounts: Key Drawbacks and Prevention

June 25, 2024

Key Insights

Sales is really the heart and soul of any company, but guess what? Many salespeople often don't get the payouts they deserve. That’s the sad reality!

You could literally ask any salesperson, and they'd probably tell you they've had some kind of mistake with their commission at least once.

Imagine the frustration that leads them to this point: many sales reps actually take matters into their own hands and keep a shadow account. They meticulously track all their incentives, payouts, salaries, and commissions themselves, doing the job HR or admin should be taking care of.

Now, think about your top salespeople spending extra time tracking their earnings in secret spreadsheets instead of doing their job of getting sales.

Well, that's shadow accounting. It devours valuable time and resources and creates a climate of suspicion.

Let's explore why they exist and how to fix this issue.

What is shadow accounting in sales exactly?

A shadow account is basically like a personal ledger that salespeople keep to track their earnings. So, instead of relying solely on the company's systems, they keep their records of every deal, commission, and incentive. This approach allows them to double-check and ensure that they receive all the compensation they rightfully deserve.

While the official accounting system tracks transactions and balances, the shadow system works quietly in the background, often for different purposes.

What is a Shadow Accounting system?

A shadow accounting system is a dynamic and super flexible parallel accounting system that operates alongside an official or primary accounting system within a business or organization. A salesperson could maintain it using Excel, a diary, or another document, and they may track every penny they are entitled to in their way. It's not a fixed system; it totally depends on the person creating it.

To solve a problem, you need to first understand the root cause. So, let's dig deeper!

What Causes Shadow Accounting?

Why would someone bother creating their makeshift calculation system if they were confident in the company's payroll processes?

The symptom is crystal clear: TRUST ISSUES!

So, why does this lack of trust exist?

Well, for starters, mistakes happen. Organizations, despite their best efforts, sometimes mess up payroll. Maybe it's a miscalculation, an oversight, or just plain old human error. Whatever the case, when employees notice discrepancies in their pay, they get anxious and lose trust in the system that very second.

Shadow accounts. They sound so harmless, right? Wrong! These things are like gremlins in the system, multiplying and causing errors behind the scenes.

Let's rip the bandaid off and expose the MAJOR drawbacks of these sneaky imposters!

5 Major Drawbacks of Shadow Accounting

Missed Opportunities:

Time spent maintaining shadow records is time taken away from core job functions. Sales reps tracking commissions in a separate system might not be focusing on generating new leads. This can lead to missed opportunities for growth and profitability..

Cybersecurity Risks:

If shadow accounting involves storing financial data outside of secure, company-approved systems, it increases the risk of a data breach. This can lead to significant financial losses, reputational damage, and legal repercussions.

Lack of Consistency and Standardization:

One of the biggest issues with shadow accounting is the lack of consistency. Different teams might use varied methods and tools for their shadow records, leading to discrepancies and a lack of standardization. This makes it difficult to get a clear, unified view of the company's financial health.

Legal Compliance and regulatory hazard:

Shadow accounting can pose significant compliance and regulatory risks. Keeping unofficial records can lead to inaccuracies that might go unnoticed until it’s too late, potentially resulting in fines and penalties, and damage the company's reputation, making it a risky practice from a legal standpoint.

Employee Morale Sinkhole:

Disagreements between official and shadow numbers can create confusion and distrust among employees. This can lead to finger-pointing, lower morale, and decreased productivity. When multiple sets of books are in play, it’s almost inevitable that conflicts will arise.

Yep, shadow accounts are a total buzzkill!

Companies, leaders, and anyone involved in figuring out compensation and releasing paychecks gotta be on their A-game. You need crystal clear communication about compensable factors, no room for confusion. On top of that, the actual pay calculations need to be squeaky clean, no weird errors that make people question everything.

You need to ensure that no employee ever feels the need to maintain their own shadow account.

All that info was just tip of he iceberg. There's gotta be more to the story.

Let's pop the hood and see what's causing the trouble. We're gonna peel back the layers and see what's really driving people to keep their own pay records in the first place?

What Causes Shadow accounting?

➜ Compensation Calculation Errors:

Sometimes, mistakes occur in calculating compensation, whether due to complex formulas, incorrect data entry, or software glitches. For instance, an employee might notice discrepancies in their paycheck due to incorrect overtime calculations or bonus payments. The last thing we want is for a salesperson to feel shortchanged, but these errors can push them towards keeping their own records to ensure accuracy.

Compensation calculation errors, even minor ones, can be disheartening for a salesperson who worked hard to achieve their targets.

➜ Lack of Visibility:

Have you ever felt like your employees are in the dark about their compensation? Surprise! That mystery breeds suspicion. If your incentive plans are complex and communication is spotty at best, your team is left wondering how much they'll actually take home. This lack of clarity leads to frustration and, you guessed it, shadow accounting. Many companies struggle to make their incentive compensation plans clear and easy to understand.

When doubt sets in employees mind, disengagement follows. Frustrated and unsure, they lose motivation. The worst part? Top performers, the very people you need most, might decide to walk right out the door in search of a clearer path to earning success.

➜ Slow or Inconsistent Payouts:

Nobody enjoys waiting for their hard-earned money. When payouts drag on or become unpredictable, trust starts to erode and employee might resort to shadow accounting just to keep track of what they're owed. Streamline your payroll process and ensure timely, consistent payouts.

➜ Disagreements About Performance Metrics:

Sometimes, the very tools used to measure success become a point of contention. If your team feels the goals they're measured against are unfair, unrealistic, or constantly changing, it creates confusion. Confused employees might not trust the official numbers and resort to shadow accounting to track progress based on their own understanding.

Alright, we've figured out why shadow accounting creeps in – These reasons we discussed are pretty common, but there might be others lurking specific to your company. The key is to avoid them at all costs.

Learning: Create a compensation system that's transparent, reliable, and frustration-free. This keeps those shadow accounts firmly in the dark ages, where they belong.

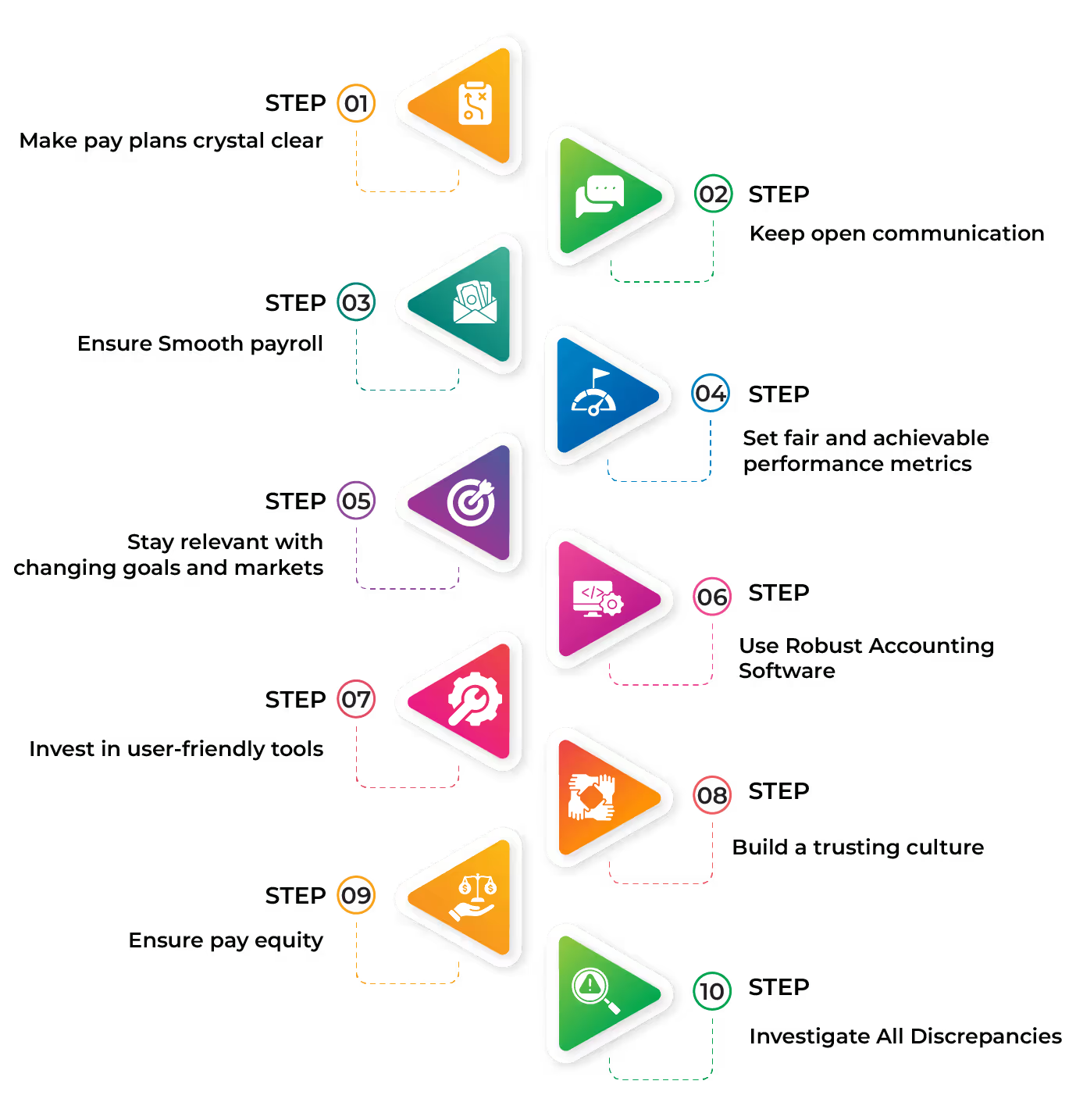

10-Step Checklist to Avoid Shadow Accounting

Tick off these points and watch shadow accounts become a distant memory. Your employees will be thanking you (and their spreadsheets can finally retire).

What are Shadow Banks?

The world of finance. Banks are like the big, established stores you know and trust. Now, shadow banks are more like specialty shops on the financial street. They offer similar services – loans, investments, that kind of thing – but they operate a little differently, outside of the traditional banking system. This means they aren't subject to the same regulations as commercial banks.

Here are some examples of shadow banks:

Investment banks:

These firms help companies raise capital and manage investments, but they don't take deposits from the public.

Hedge funds:

These pools of money invest in a variety of assets with the goal of high returns, often using complex strategies.

Private equity firms:

These firms invest in companies that are not publicly traded on the stock market.

Money market funds:

These funds pool investor money and invest it in short-term debt instruments, like commercial paper.

Finance companies:

These companies provide loans to consumers and businesses, often specializing in areas like auto loans or mortgages.

Why are Shadow Banks a Concern?

Because they're not as closely watched, they can be a bit risky for the whole financial system. Imagine one of these shadow banks hits a rough patch – their whole house of cards could come tumbling down. And guess what? That mess can drag regular banks and the whole economy down with it.

It's kind of a domino effect, you see? That's why people worry about shadow banks – they can be a ticking time bomb if things go south.

Wrapping Up

Happy salespeople produce 37% more profit- t's not just a dream—it's achievable!

Just start with the basics

It all boils down to building trust.

Let your salespeople know that their hard work is seen and valued, without ever doubting it. When trust runs deep, there's no need for shadow accounts or second-guessing.

It's about creating an environment where everyone feels appreciated and supported, and that's where the magic happens.

The ball is in your court, you hold the master key to employee happiness and higher ROI.

ReKennect : Stay ahead of the curve!

Subscribe to our bi-weekly newsletter packed with latest trends and insights on incentives.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Your data is in safe hands. Check out our Privacy policy for more info