Blog

Commission Accounting: Streamlining Incentive Compensation

August 8, 2023

Key Insights

Never take your eyes off the cash flow because it's the life blood of business.

Sir Richard Branson

Money is a crucial part of any business.

For this reason, the money you receive and the money you spend must be accounted for better planning of your business.

It is for this purpose that businesses document and record their cash flow in all areas of business operations.

But how do we account for commission expenses?

Every sales call for a commission. It is a recurring cost that companies must foresee and allocate a budget for as it is a powerful tool that will ensure positive results and behavior.

With a lot of purposes that it fulfills, let us look at why organizations must keep better track of commission accounting.

In this article, we will try to unravel the relevance of commission accounting, its importance in operations management, its benefits, and the future trends in commission accounting.

So scroll down for more!

Importance of Commission Accounting

Commissions are an inevitable part of sales management, taking up a major portion of the sales budgeting and allocation so it is important to get it documented and tallied at regular intervals. Now, commissions are considered in two different terms. It is revenue when the salesperson earns it for the sale he made, and it also represents a crucial aspect of recurring revenue, ensuring a consistent financial stream for businesses.

Now, commissions are considered in two different terms.

- It is revenue when the salesperson earns it for the sale he made.

- It is an expense when the company has to pay a salesperson for the business.

So, the question is, if commission is to be marked as revenue or expense, just record it as required. Why this hue and cry?

The tedious part of sales commission accounting comes in two ways: the complexity of the calculation, second the law that bounds recording of commission. However, implementing a clear and transparent process on how to calculate sales commission, often aided by a sales commission tool, can alleviate these challenges.

Commissions are usually calculated as a percentage of the sale made. But more than often this calculation does not follow a simple flat rate structure.

Depending on the company the process can get complicated.

- For one reason, they can include tiered systems where each person gets a different commission depending on their job profile.

- Complex formulas can come in the commission calculation when multiple performance metrics are taken into account.

- Also, each sale is of different value. So even a flat rate structured calculation also gives varying commission rates for each sale.

Along with these calculation differences, revenue regulations like ASC 606 also puts a legal bind in the way commissions are documented. Under ASC 606, commissions are recorded as revenue following the accrual accounting method.

By this accounting method, known as Commission Expense Accounting, the commission is recorded as an expense or revenue when the sale is made and not when it is paid. So in practice, a salesperson may make a sale this month but will receive the commission only next month along with their salary.

These variations in recording the commission and actually paying it to the salesperson also add up to the complexity of commission accounting.

For more information on incentive calculation, How to Calculate Sales Commission & Maximize Your Earnings

Benefits of Effective Commission Accounting

Despite these tedious and confusing steps of commission accounting, it is important to document and keep your balance sheet clear.

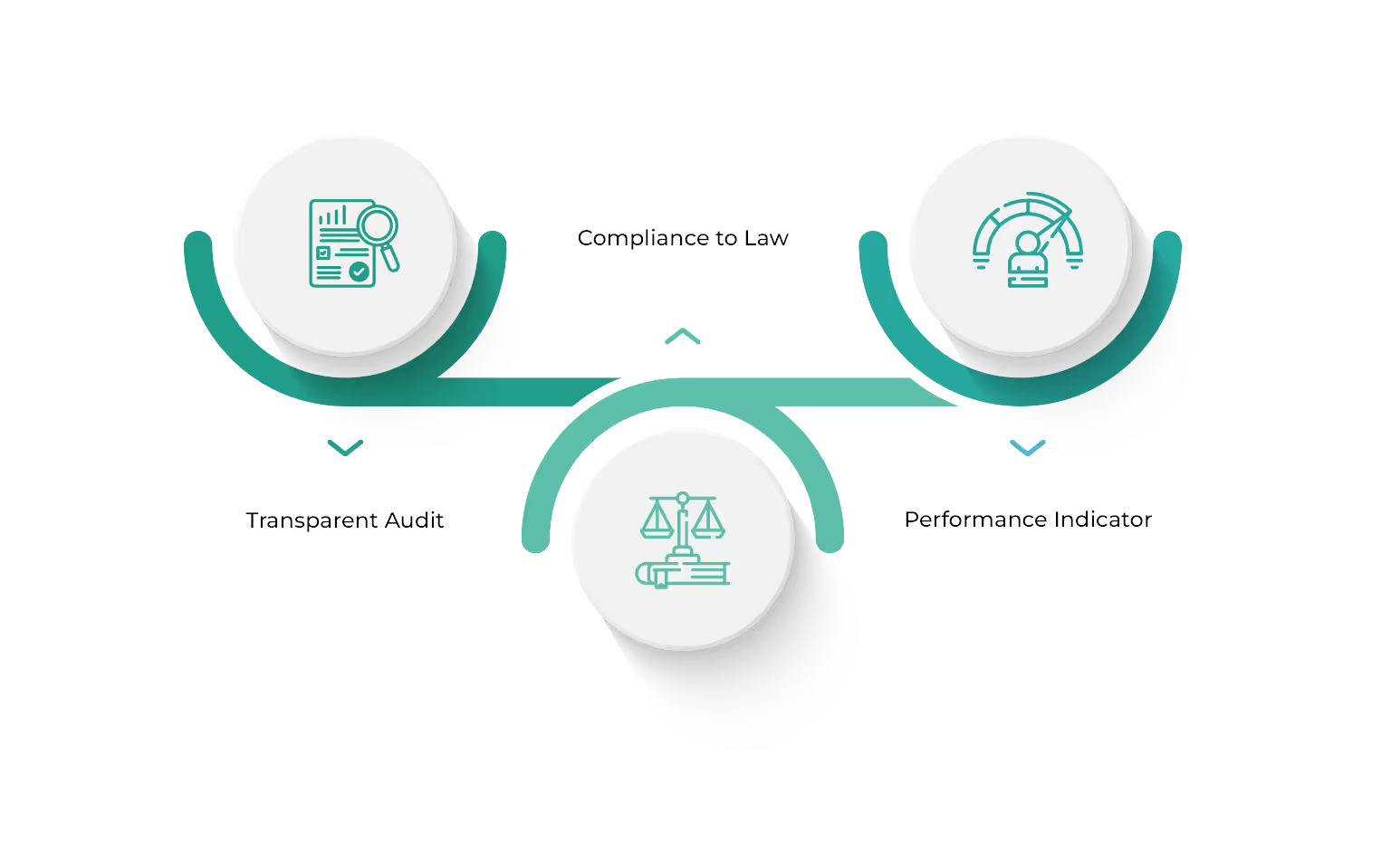

Transparent Audit

Commissions come under operational expenses categorized under SG&A (Selling, General, and Administrative Expenses). Since commissions follow the accrual method, proper documentation of commissions gives transparency in the way the finances for commissions were handled.

Accounting for commissions accurately and keeping your balance sheet clear makes auditing straightforward.

Compliance to law

Ever since ASC 606 was implemented in 2017, strong guidelines for revenue regulations and documentation have been in place. It says that businesses must keep more detailed records of commission costs, and demonstrate the benefits of commission to the business as the seller, as well as the impact of commission payments. Hence, every business must get their commissions accounted for by law. Deferred commissions ASC 606 regulations ensure accurate reporting and compliance with accounting standards.

Hence, every business must get their commissions accounted for by law.

Performance Indicator

The commissions a company paid its salesforce are reflective of its performance and growth, demonstrating the accountability in sales. Commissions are given only when a salesperson has achieved his quota and becomes eligible for incentives. When the balance sheet accounts for these commissions, it shows the competitiveness of the company and its salesforce, its growth potential, and its success.

Hence, commission accounting also acts as proof of the growth and success of the company.

How much do you know about pharma sales compensation? Read more about the topic in Best Practices and Strategies for Pharmaceutical Sales Compensation.

Future Trends in Commission Accounting

We have discussed earlier how commission accounting can become complex when various factors come into play.

So how can we simplify this tedious process?

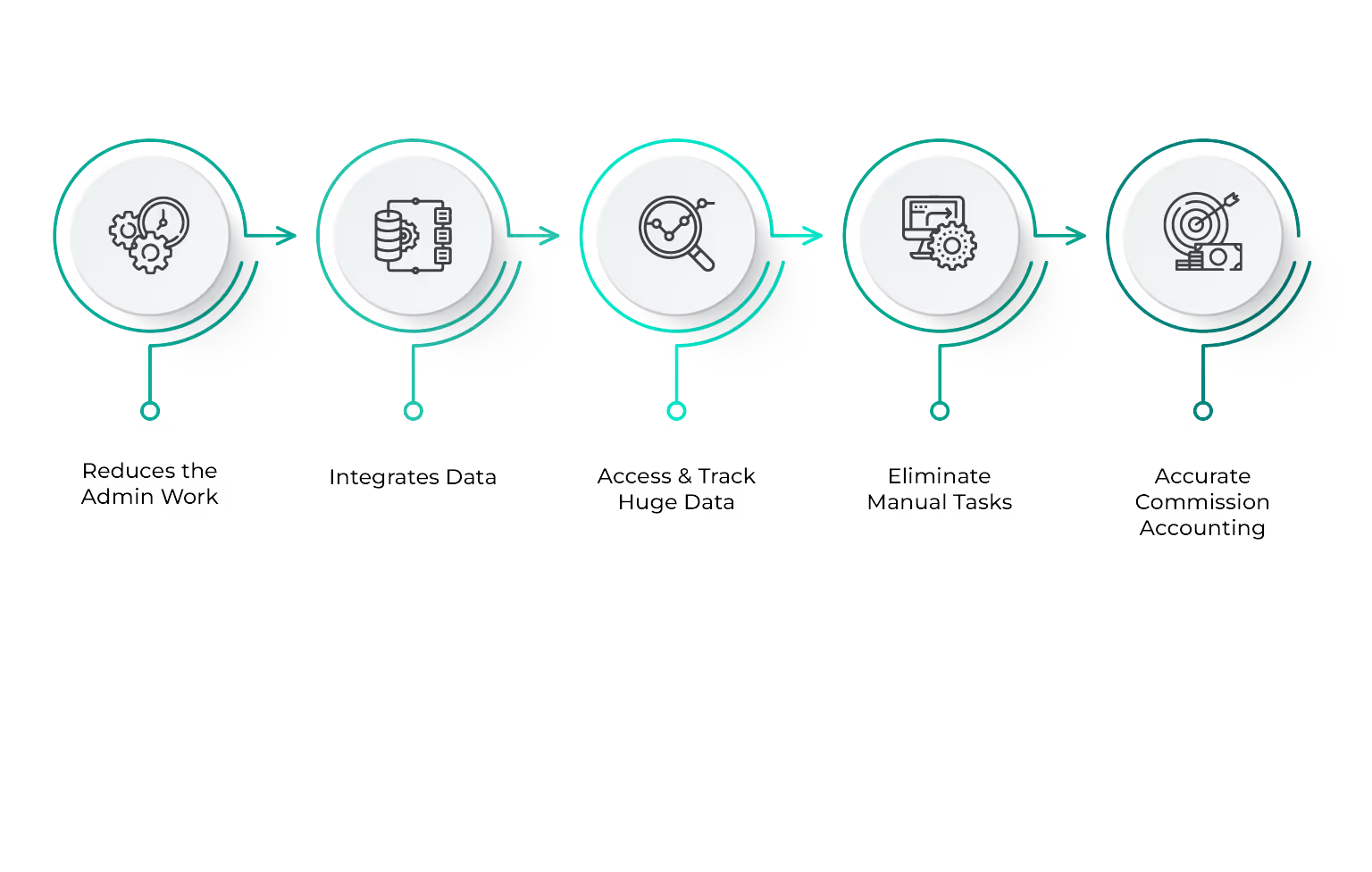

The future trend and solution in commission accounting is automation.

- Automating your commission accounting reduces the admin work of sitting over a spreadsheet and trying to make sense of when the sale was made and when the money was transferred. Implementing sales commission best practices is crucial in optimizing the automation process and ensuring accurate and efficient commission calculations

- Since all data is stored in a central repository, integration of data spread across systems is easier. This also means the tool can compute complex formulas by taking into consideration KPIs, sales size, job profile, etc.

- By accessing and tracking huge data and presenting it in a lucid format, the commission accounting automation tool makes creating audit reports easier and the audit process transparent and straightforward. Integration with advanced incentive management systems enhances the tool's capabilities, providing a comprehensive solution that not only streamlines commission accounting but also optimizes incentive structures for increased efficiency and accuracy across the organization.

- Eliminating the manual tasks of entering data reduces errors, enhancing the accuracy and authority of the data and calculation.

- It helps salesforce get clarity on the estimation of their commission and real-time visibility of their commissions thereby improving their confidence in commission accounting and reducing dissatisfaction.

While handling large amounts of data, it is always better to incorporate digital tools, such as a sales margin percentage calculator, that can reduce the human effort involved and enhance operations accurately and efficiently.

To read more on incentive automation, check Why you should automate your sales commissions?

Conclusion

Commission accounting is a compulsory process that companies are bound to do by law and for ease of operations.

When such crucial work is involved it is always wise to incorporate state-of-the-art technology that will ensure you follow the regulations accurately and properly. It not only ensures the integrity of your brand but also makes your internal operations seamless.

Especially with commission, which is crucial in ensuring the performance, commitment, and dedication of the salesforce, automation is the ideal choice for transparent operations.

Kennect offers automation of your incentive compensation management and sales performance management to create transparency and achieve operational efficiency.

For more information, Book A Demo Now!

ReKennect : Stay ahead of the curve!

Subscribe to our bi-weekly newsletter packed with latest trends and insights on incentives.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Your data is in safe hands. Check out our Privacy policy for more info