Financial Industry

Enhancing Financial Services Sales with Next-Generation Sales Performance Management Technology

Companies in the Financial Services industry need help to manage their salesforce due to complex sales processes and products, dispersed sales force, inaccurate sales forecasting, and a lack of transparency.

SPM solutions can help automate sales processes, improve visibility and forecasting accuracy, and increase sales productivity, motivation, and data-driven decision-making.

Kennect offers state-of-the-art SPM solutions for the financial services industry with real-time data analytics and automation capabilities.

It’s true! Most sales leaders struggle to determine the best sales comp software for their reps. After all, no single best solution applies to all organizations, and more often than not, this quest for finding the right balance boils down to the good old “trial and error”.

The financial services industry is a dynamic and fast-paced sector undergoing a significant transformation with the advent of fintech, digital transformation, and automation. Sales performance management (SPM) has emerged as a critical aspect of ensuring growth and success in this era of constant change.

Sales comp plans for Financial Services are as diverse as they can get! It can be a real challenge to find a tailor-made solution that perfectly fits the organization’s goals of designing an IC plan and ensuring your reps are paid relatively. Even for the best in the business!

- Complex sales processes and products - With an increasing number of financial products and services being offered, the sales process has become more complex, making it challenging for sales employees to keep up with the latest products and services.

- Dispersed sales force - Many financial institutions have a large, dispersed sales force, and managing and motivating them is challenging.

- Inaccurate sales forecasting - Financial institutions rely on accurate sales forecasting to make informed decisions, but the lack of real-time data makes it challenging to achieve accurate forecasts.

- Lack of transparency and visibility - With traditional compensation management methods, it's challenging to provide real-time visibility into the sales team's performance, making it difficult to make data-driven decisions.

To address these challenges, financial services companies choose SPM solutions designed to help manage the sales force effectively and improve sales forecasting accuracy.

These solutions include:

- Automation of sales processes - SPM solutions automate the sales process, making it easier for sales employees to keep up with the latest products and services.

- Enhanced visibility and transparency - With real-time data and reporting, SPM solutions provide better visibility into the sales team's performance, allowing financial institutions to make data-driven decisions.

- Improved sales forecasting accuracy - SPM solutions make it easier to achieve accurate sales forecasting, providing financial institutions with better insights into future business growth.

The implementation of SPM solutions in the financial services industry brings numerous benefits, including:

- Increased sales productivity - Automating the sales process and providing real-time visibility into sales performance leads to increased sales productivity.

- Improved sales employee motivation - With accurate and real-time data, sales employees are better motivated, knowing that their performance is being accurately tracked and rewarded.

- Increased operational efficiency - Automating the sales process and improving visibility into the sales team's performance leads to increased operational efficiency.

- Better data-driven decision-making - With accurate sales forecasting and real-time data, financial institutions can make better data-driven decisions, leading to improved business growth.

Kennect is a state-of-the-art SPM solution catering to the financial services industry's needs. With its automated approach, Kennect helps financial institutions streamline their sales processes and improve forecasting accuracy.

Kennect integrates with existing systems and provides real-time visibility into the sales team's performance, allowing financial institutions to make data-driven decisions.

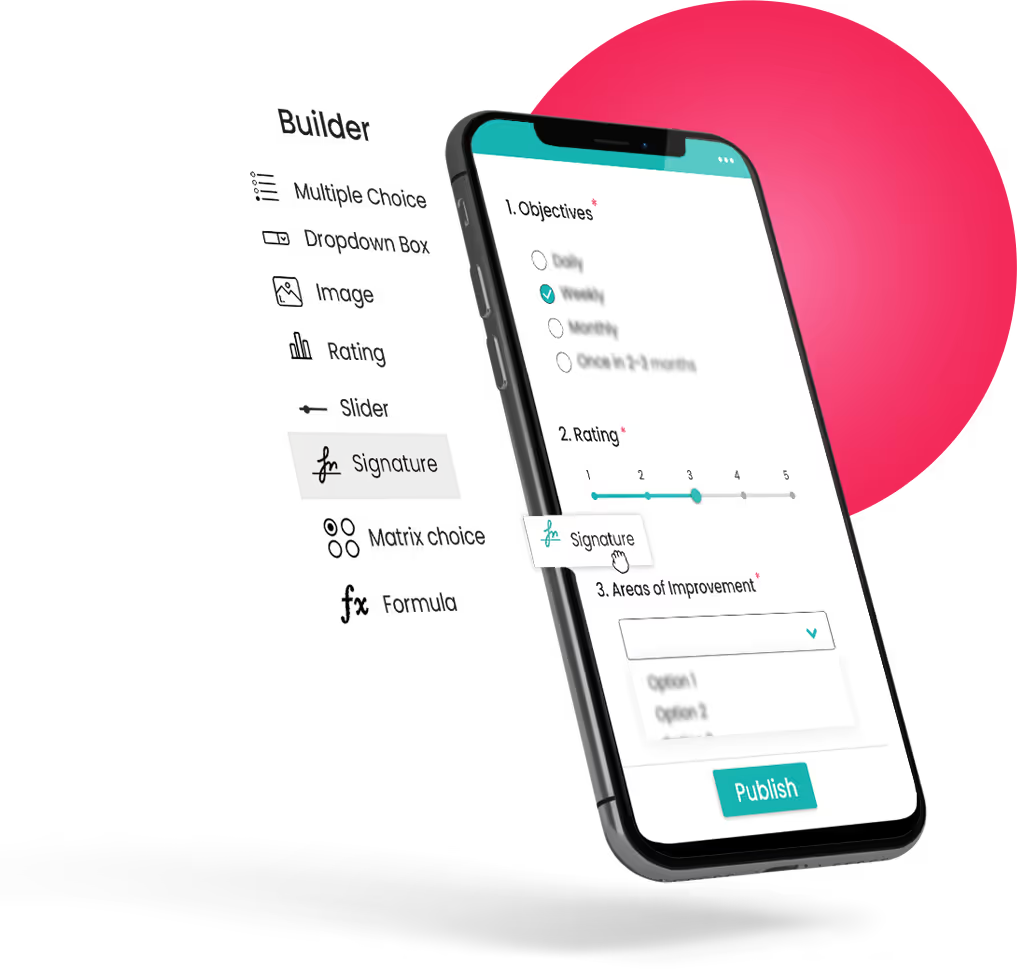

With its no-code capabilities, Kennect makes it easy for financial institutions to implement and manage complex sales processes and incentive compensation plans.

Kennect's unique features, such as real-time data analytics, customizable dashboards, and actionable insights, provide financial institutions with a complete overview of their sales performance.

The solution also offers powerful automation capabilities, enabling financial institutions to automate complex sales processes, reducing the risk of human error and improving operational efficiency.

.avif)

.jpg)